US treasuries were better early this morning on increased fears of a Greek debt default. The 10 yr note yield at 8:00 at 2.32% down 4 bps from yesterday’s close, MBS price +16 bps from yesterday’s close. At 8:30 May housing starts and permits were released; starts were expected to have declined 4.0% as reported down 11.1%; building permits though were stronger, expected -3.4% were up 11.8%. Starts were thought to be at 1090K units (yr/yr), starts as reported at 1040K; April starts were revised higher, from 1135K to 1170K. The best two month period since Nov and Dec 2007. Permits for future projects climbed to the highest level in almost eight years, indicating activity might pick up. The starts decline isn’t as negative as the number indicates, starts in April were up 22.1% so the decline put in context isn’t much. The initial market reaction didn’t change the prices or rates on the MBS or treasury markets; at 8:45 the 10 yr at 2.32% -4 bp, 30 yr MBS price +16 bps. (see below for 9:30 levels).

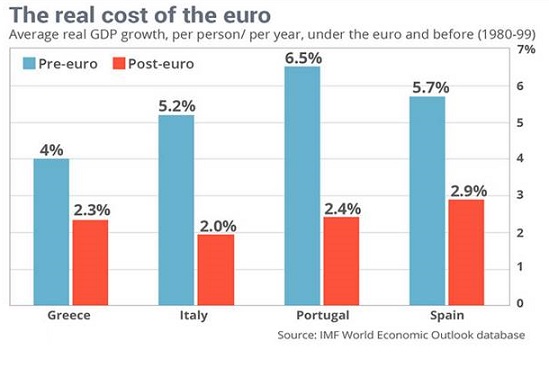

Markets continue to fret over the Greek debt crisis. Talks collapsed over the weekend with the IMF pulling out its negotiators late last week and negotiators in Brussels over the weekend became increasingly agitated over Greece’s reluctance to accept what had been defined as a ‘take it or leave it’ proposal from creditors last week. At the present moment there is increasing concerns that Greece will default at the end of the month, unable to pay €130B of debt payments due in two weeks. Another round of negotiations begins today. Greece will eventually default, the country will not or cannot agree to the reforms demanded by creditors. A new fear is brewing in the EU now; what will happen if Greece leaves the EU and eventually may return to prosperity? Will other countries follow? Reading an article by Brett Arends he points out that Southern Europe’s economies did much better before the EU than they do now in terms of growth. Whether there is substance in the new fears or simply using old data to illustrate a point is certainly debatable; what isn’t is that Greece cannot pay its debts unless it gets more free money from creditors---kicking the can, like using on credit card to pay another card.

At 9:30 the DJIA and the other key indexes opened unchanged after trading weaker earlier this morning. The 10 yr note at 9:30 has slipped from its best level at 2.32% back to 2.34% -2 bp from yesterday’s close. 30 yr MBS price +9 bps from yesterday’s close and -7 bps from 9:30 yesterday.

The remainder of the session should be quiet ahead of tomorrow’s FOMC meeting and Yellen’s press conference. There is little doubt the Fed is ready to increase the FF rate; most still hold that it will be increased at the Sept meeting. Our focus is on how the policy statement frames the economy now and the outlook painted by the Fed. Today’s starts and permits were encouraging but recent reports on manufacturing and consumer spending haven’t been encouraging. Spending did increase in May but still consumers are reluctant to spend. The boost from lower gasoline prices has slowed, prices at the pump have increased $0.80/gallon in Indianapolis and more in the west. Markets put a lot of emphasis on lower energy prices that would increase consumer spending. There is no inflation now or not much on the radar. How will the FOMC and Yellen frame it? Data dependent as has been Yellen’s emphasis on a rate increase?

Technically speaking; the 10 yr note where your attention should be, is continuing to fail on rallies at our resistance at 2.33%, a couple of anemic pushes below it that have not been sustained more than a couple of hours. We don’t expect the strong resistance to break today with the FOMC tomorrow and the uncertainty over Greece. Tomorrow the policy statement and Yellen’s press conference, and events in Europe will set the next move in the rate markets. Currently technically bearish, we need to keep that in mind as the next 24 hours unfolds.

PRICES @ 10:00 AM

10 yr note: +4/32 (12 bp) 2.34% -1 bp

5 yr note: +2/32 (6 bp) 1.69% -1 bp

2 Yr note: unch 0.71% unch

30 yr bond: +5/32 (15 bp) 3.08% -1 bp

Libor Rates: 1 mo 0.185%; 3 mo 0.283%; 6 mo 0.449%; 1 yr 0.791%

30 yr FNMA 3.5 July: @9:30 102.91 +9 bp (-7 bp frm 9:30 yesterday)

15 yr FNMA 3.0 July: @9:30 103.31 +2 bp (+10 bp frm 9:30 yesterday)

30 yr GNMA 3.5: @9:30 103.67 +5 bp (-16 bp frm 9:30 yesterday)

Dollar/Yen: 123.40 -0.02 yen

Dollar/Euro: $1.1245 -$0.0038

Gold: $1178.30 -$7.50

Crude Oil: $59.77 +$0.25

DJIA: 17,851.76 +60.59

NASDAQ: 5041.44 +11.47

S&P 500: 2089.45 +5.02

http://globalhomefinance.blogspot.com

No comments:

Post a Comment